Class 12th Account chapter 1 question 23 solution (ts grewal)

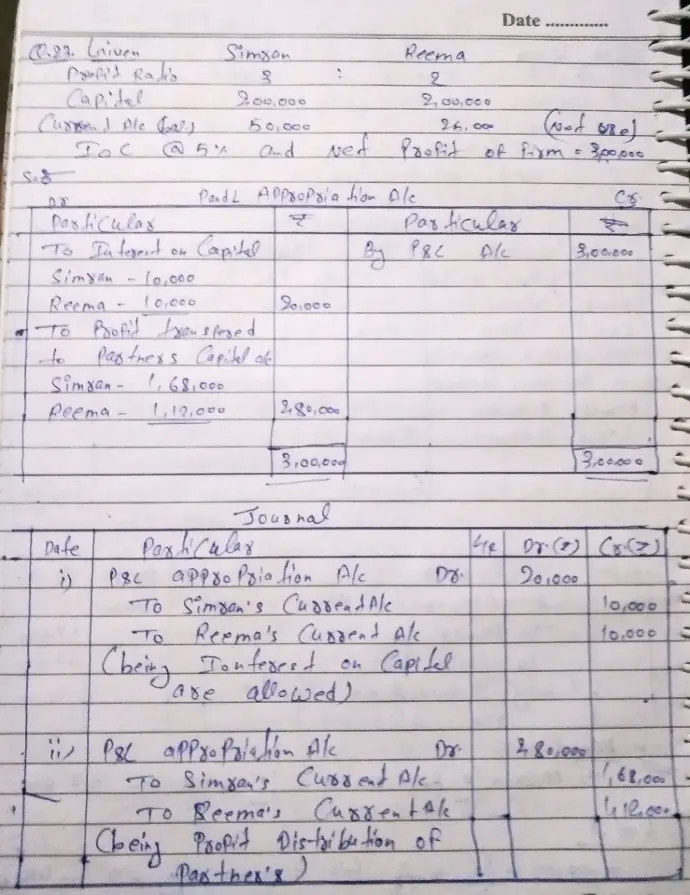

23. Simran and Reema are partners sharing profits in the ratio of 3 : 2. Their capitals as on 1st April, 2023 were ₹ 2,00,000 each whereas Current Accounts had balances of ₹ 50,000 and ₹ 25,000 respectively.

Interest on capital is to be allowed @ 5% p.a. Net profit of the firm for the year ended 31st March, 2024 was ₹ 3,00,000.

Pass the Journal entries for interest on capital and distribution of profit. Also prepare Profit & Loss Appropriation Account for the year.

[Ans.: (i) Dr. Profit & Loss Appropriation A/c by ₹ 20,000;

Cr. Simran’s Current A/c by ₹ 10,000 and Reema’s Current A/c by ₹ 10,000;

(ii) Dr. Profit & Loss Appropriation A/c by ₹ 2,80,000;

Cr. Simran’s Current A/c by ₹ 1,68,000 and Reema’s Current A/c by ₹ 1,12,000.]

[Hint: Interest will not be allowed on Current Account balances.]