Class 12 accountancy solution (Ts grewal )

Q19.

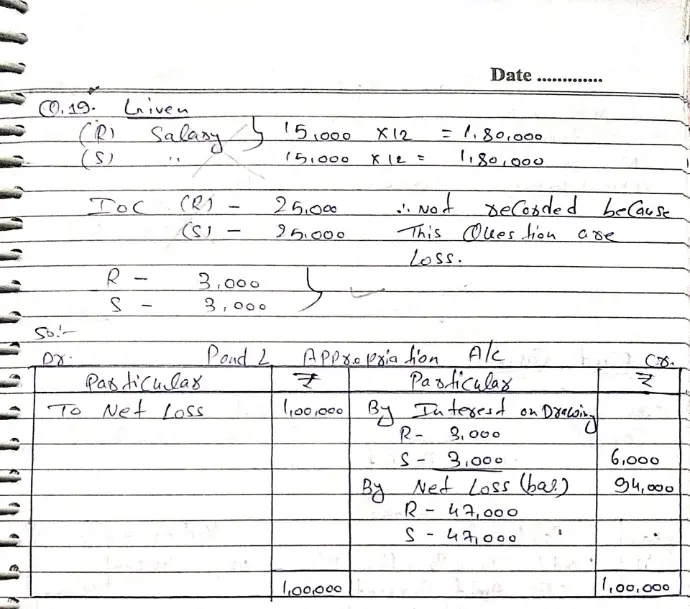

Reema and Seema are partners sharing profits equally. The Partnership Deed provides that both Reema and Seema will get monthly salary of ₹ 15,000 each, Interest on Capital will be allowed @ 5% p.a. and Interest on Drawings will be charged @ 10% p.a. Their capitals were ₹ 5,00,000 each and drawings during the year were ₹ 60,000 each.

The firm incurred net loss of ₹ 1,00,000 during the year ended 31st March, 2024.

Prepare Profit & Loss Appropriation Account for the year ended 31st March, 2024.

[Ans.: Loss – ₹ 94,000; Reema’s Share – ₹ 47,000; Seema’s Share – ₹ 47,000]

SOLUTION : -